Martin and Graham remember the era when review meetings were largely based on reporting that ‘your pension has grown by X% and your investment bond by X%’, followed by a discussion of whether a fund switch was warranted.

Financial planning is now more interesting and engaging for clients in a couple of ways. Firstly, many of our clients’ assets are held on online platforms, enabling them to view their own portfolios whenever they require, rather than waiting for a valuation to arrive. Secondly, lifetime cashflow modelling has transformed the financial planning process for forward-looking advisers.

Speak to our team

We believe that the truth about money is not ‘what percentage has that fund grown by?’, but that money is there to support someone’s lifestyle, as life is not a dress rehearsal. We encourage our clients to imagine how their lives would evolve in an ideal scenario, and then build and tailor financial plans around this desired journey. This can be very different for each individual client. For example, some clients may be motivated to maximise the estate that they leave to children. Other clients may want to tick off a ‘bucket list’ and simply want reassurance that their wealth will be sufficient for life. We are not here to try to stop people spending money – our duty is to help people make informed and sustainable decisions.

Cashflow modelling software enables different financial and life decisions to be easily compared – eg the difference between retiring at 60 and 65, different levels of spending in retirement, or the potential impact of care fees.

Please let us know if you want to explore and discover what may be possible for you.

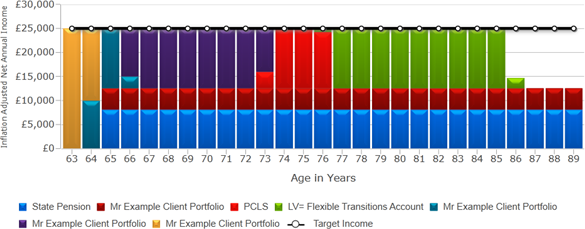

This chart below shows the estimated yearly income someone will receive from their pension, savings and investment plans.

All income shown is the net amount received after tax, and values have been adjusted to reflect inflation at an annual rate of 2.50%.

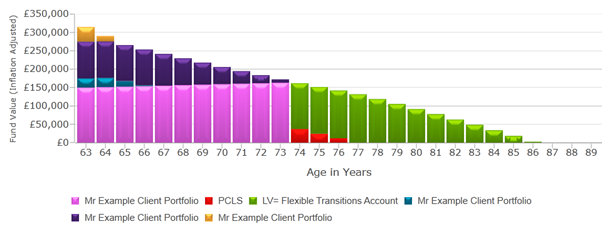

This chart shows the value of each of the assets included in the projection in retirement. Again, values have been adjusted to reflect inflation at an annual rate of 2.50%.

So, in this example, their money would run out at age 85. This is really the starting point for further discussions. What if inflation, investment returns or interest rates are higher or lower than assumed? Are they expecting an inheritance or planning to downsize, which will inject capital into the plan? Or conversely, are they planning to help children or grandchildren during their lifetime or have any other projected items of capital expenditure? All these scenarios can be easily compared and contrasted using the software.

Our team is ready to discuss your financial goals

Backhouse Independent Financial Services Limited is authorised and regulated by the Financial Conduct Authority. FCA Firm Reference Number: 126319. https://register.fca.org.uk For further information on our costs and services, please contact us.

The information and guidance contained within the website is subject to the UK Regulatory Regime and is therefore primarily targeted at customers in the UK.

Oakmount House 9 Carrside Lomeshaye

Business Park Nelson, Lancashire BB9 6RX

Telephone:

Email:

Monday - Friday: 9:00 am to 5:00 pm

© Backhouse Independent Financial Services Limited.

Registered in England.: Company No. 01140032.